Do these incentives really create the loyalty that truly connects the customer to the brand? Well it could be argued that it depends. It depends on what’s being sold, the frequency and volume of purchase and whether it is a service or product. This means that we have to have a way to measure the effectiveness of the program.

In order to design the measurement system we have to consider the potential variables. Including

- Lead-time to customer profitability

- The ease to switch to substitutes

- The cost of customer maintenance

- The potential customer lifecycle

Long life cycle customers – Business banking industry

1. It’s easier

2. We need volume and thus we usually target a larger market with the hope that this strategy provides greater opportunity for success with reduced risk. Our conversion is usually on the low side which has its obvious impact on the cost of acquisition.

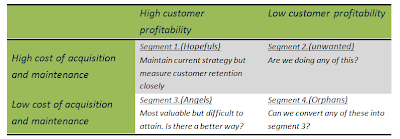

The next part to our strategy is to use the Hopefuls to create Angles. This is the hard part deploying tactics ranging from referral programs to various form of cross sell methodologies.

Our focus here is to enhance the existing strategy but with the main difference in using the “common interest between customer and banker” as the key driver to loyalty.

What could this common interest be? In the case of the commercial bank that lends money to business it HAS to be the financial statements.

This creates a significant opportunity to leverage on this on these statements to create long term relationships.

How can this be done? In our opinion education is the starting point. The undisputed fact is financial statements are the globally accepted vehicle that measures business performance, yet they are the mostly underutilized. The reason is simple, financial statements are not designed to be a communication platform. In specific how the banker sees the financial and how the business sees the financials are very different. We often use the analogy that the banker speaks Portuguese and the business person speaks Spanish both languages sound similar but very differently understood. The business person is income focused and the banker is balance sheet focused just as a starting difference.

Business people find it extremely valuable to know how the banker looks at a set of numbers and then if you can add additional understanding to help the business person to use his financial as a real management tool is the pathway to true loyalty.

Can you imagine the discussion between two business people “my bank has shown me how I can use my financials to improve my banking risk and manage my business in a more effective way, for example I had no idea my business is cash absorbing when we grow”.

We deliver this education process through our One Page financial scorecard that connects all the moving parts (Income statement, Balance sheet and Cash flow statement) into a story about the business empowering participants to understand how different actions and strategies impact their financial performance both from the business perspective and the bank perspective.

An example of the interactive scorecard shown below clearly helps employees understand that increasing revenues is not the same as making money. We believe in the adage:

“Revenue is vanity, profit is sanity and cash is king”

Our Mission … to help individuals and companies achieve higher performance through interactive financial statements learning.

Emotion and the power of stories is how human beings act and learn

We have created a way to emotionally compel organizations to act through the power of the financial story. This story can be broken down in to 5 simple chapters that anyone can learn.

The story of Financial Discipline is easily mastered in 5 chapters (As depicted in the right hand side of scorecard):

Chapter 1 – Growth quality

Chapter 2 – Synchronizing operational profit with changes in growth

Chapter 3 – Working and fixed capital alignment

Chapter 4 – Cash impact and the road to sustainable cash flow

Chapter 5 – Creating value through the return on capital employed

The story can be summarized in the ONE PAGE FINACIAL SCORECARD. It is

- Informative

- Fun

- Engaging

- Compels organizations and individuals to take action

- Completely interactive enabling changes based on any decision isolating the impact on that decision on the income statement, balance sheet and cash flow.

Our primary solution is education. We train people to tell the financial story through 5 easily mastered chapters.

The story is brought to life in a unique and dynamic way through the interactive tool, the one page financial scorecard.

Contact Alan Adler at aadler@gfbridge.com or Andre Gien at agien@gfbridge.com

No comments:

Post a Comment